Risks reported to the company’s Board of Directors

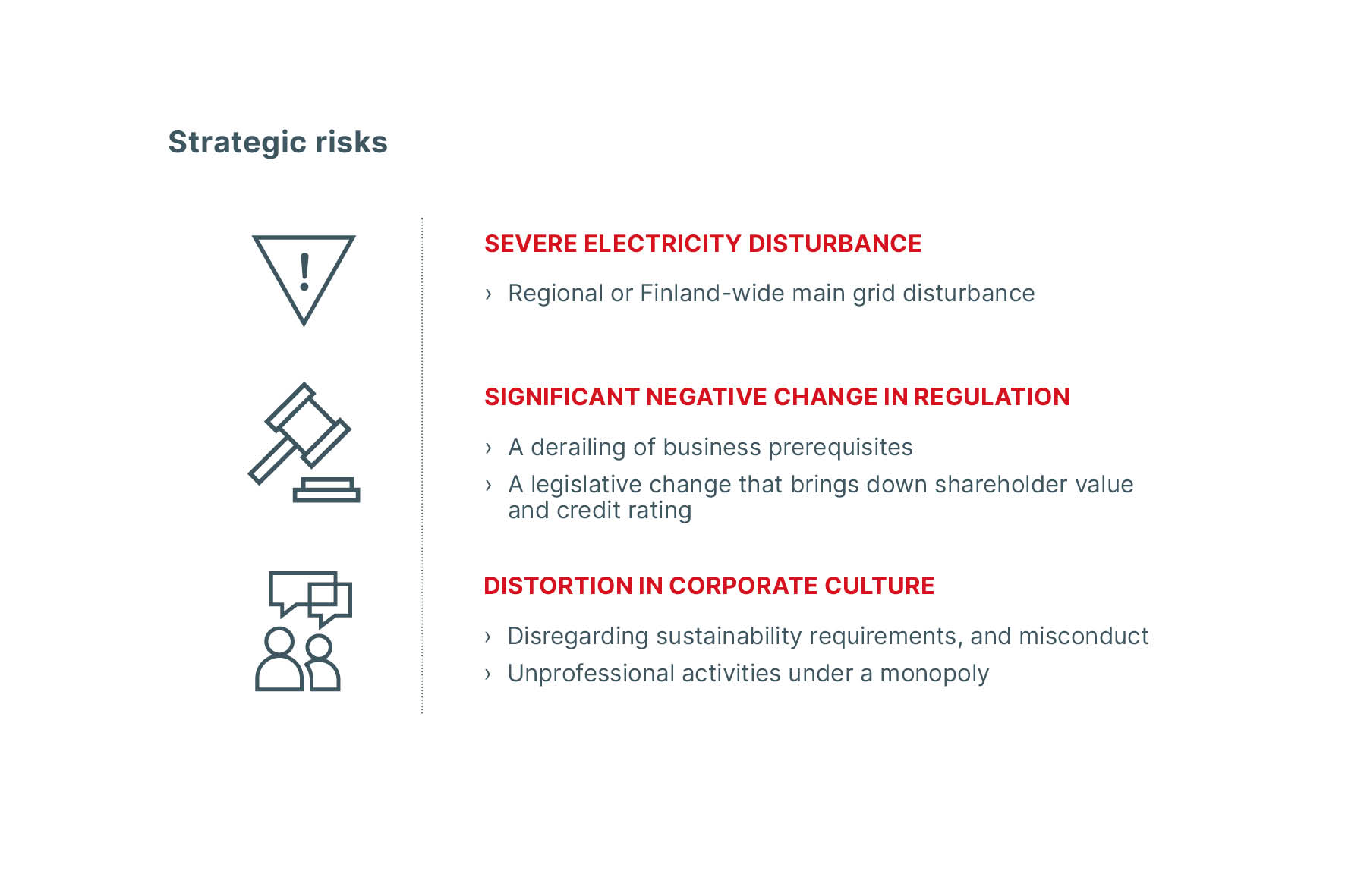

Strategic risks

Strategic risks are considered to be events that may lead to a material deterioration in the company’s ability to operate or in its corporate image or, in the worst-case scenario, events that may lead to the company’s operations being called into question by society.

Significant business risks

Significant business risks are considered to be events that may have a critical impact on the company’s ability to carry out its financial obligations. Risks are evaluated on a comensurable basis taking into account apart from probability and financial impact also other factors such as rate of change, impact on system security and on brand image.

Risk descriptions

The strategic and significant business risks reported to the Board of Directors are described in more detail in the document Euro Medium Term Note Programme.

Updated 29.4.2024