Frequency containment reserves (FCR-N, FCR-D up and FCR-D down), transactions in the hourly and yearly markets

Fingrid procures some of the relevant obligation for Frequency Containment Reserves from the yearly market, from power plants and consumption resources located in Finland, on the basis of competitive bidding. In addition, Fingrid procures reserves from the direct current transmission links from Estonia as well as through daily purchases from the hourly market in Finland and the other Nordic countries. On this page you can find information on procured volumes and prices on the yearly and hourly markets.

Yearly market

In the yearly market the price is constant during the entire calendar year. All market participants receive the same compensation for maintaining reserve capacity. The auction for the yearly market takes place once a year: during autumn of the previous year. The procured volume and the price depend on the outcome of the auction. The table below presents the volumes and the prices from recent years. The volume is the maximum capacity that is available for reserve provision in the yearly market. The actual volume varies from hour to hour depending on how much free capacity the reserve providers have.

| Year |

FCR-N price (€/MW,h) |

FCR-N |

FCR-D up price (€/MW,h) |

FCR-D up volume (MW) |

FCR-D down price (€/MW,h) |

FCR-D down volume (MW) |

|

2011 |

9,97 |

71,0 |

1,48 |

244,3 |

|

|

|

2012 |

11,97 |

72,7 |

2,80 |

346,9 |

|

|

|

2013 |

14,36 |

73,5 |

3,36 |

299,8 |

|

|

|

2014 |

15,80 |

75,4 |

4,03 |

318,7 |

|

|

|

2015 |

16,21 |

73,6 |

4,13 |

297,5 |

|

|

|

2016 |

17,42 |

89,0 |

4,50 |

367,0 |

|

|

|

2017 |

13,00 |

55,0 |

4,70 |

455,7 |

|

|

|

2018 |

14,00 |

72,6 |

2,80 |

435,0 |

|

|

|

2019 |

13,50 |

79,0 |

2,40 |

445,6 |

|

|

|

2020 |

13,20 |

87,1 |

1,90 |

458,3 |

|

|

| 2021 | 12,50 | 105,8 | 1,80 | 425,0 | ||

| 2022 | 12,24 | 102,8 | 1,90 | 430,6 | 10,0 | 114,4 |

| 2023 | 19,10 | 67,7 | 2,81 | 345,1 | 9,99 | 186,4 |

| 2024 | 25,39 | 67,5 | 4,00 | 347,8 | 9,50 | 245,2 |

Hourly market

Reserve providers may participate in the hourly market by signing a contract with Fingrid. The hourly market is used for additional procurement once a day if necessary. FCR-N and FCR-D up and FCR-D down all have their own market.

Bids to the hourly market are used in price order. Fingrid confirms transactions for the next day on the previous evening. The pricing method used is marginal pricing, and the price is defined separately for each hour.

Transactions on the hourly market, FCR-N

Transactions on the hourly market, FCR-D

Transactions on the hourly market, FCR-D down

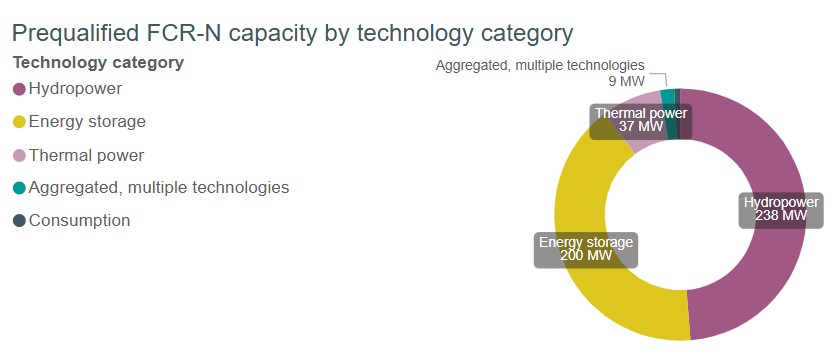

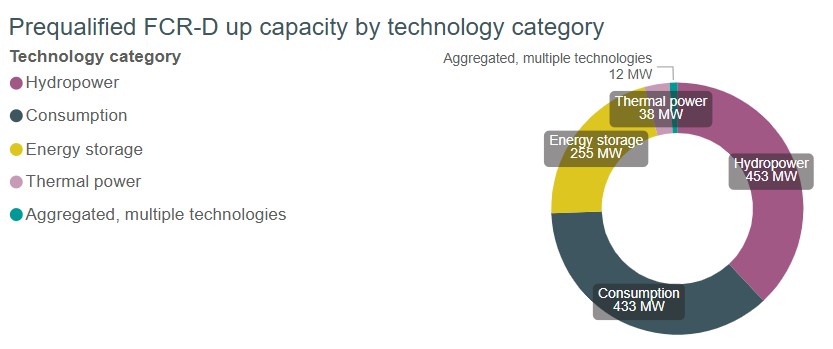

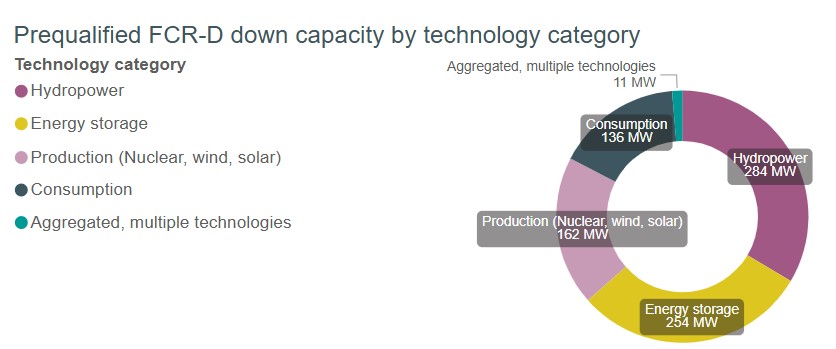

Certified capacity 5.6.2024

Details

Taneli Leiskamo

Expert

tel. +358 30 395 5240