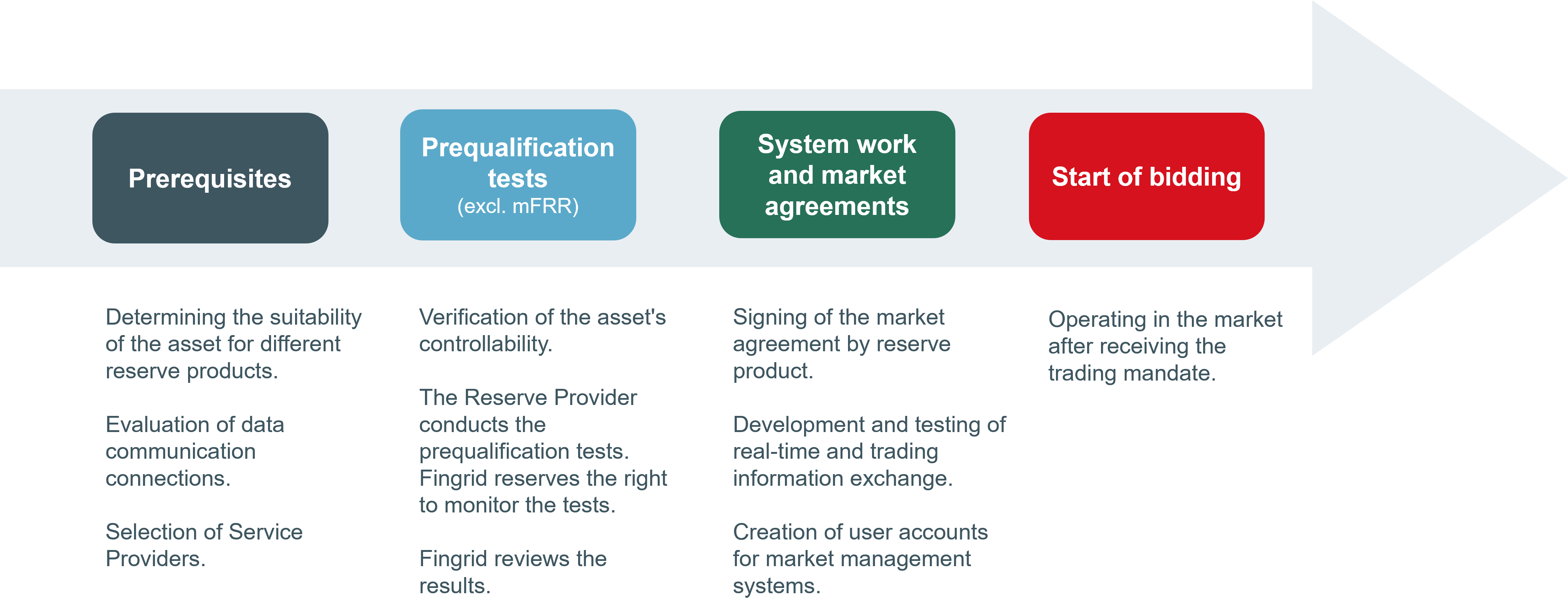

How to participate in the reserve markets

The path to participating in the reserve markets begins with familiarizing yourself with the operation of the power system reserves and reserve markets, as well as contacting Fingrid’s reserve market customer contacts persons and, at a later stage, technical experts. The Reserve Provider can carry out the tasks and implementation of the market entry process independently or with the help of Service Providers. See the list of service providers operating in the reserve markets: Reserve Providers and Service Providers.

Requirements

Reserve Provider must:

- Be the owner of a controllable resource or a party in its open electricity supply chain (either an electricity retailer or balance responsible party).

- A party outside the electricity supply chain can also act as a reserve provider under certain conditions. Read more on the Independent Aggregation (IA) page. Currently, independent aggregation is possible in FFR, FCR-D, FCR-N, and aFRR reserves.

- If the Reserve Provider is not the owner of the resource, they must have the owner's permission for reserve use of the asset.

- If the Reserve Provider is not the balance responsible party for the resource, depending on the reserve product, they must either agree on the reserve use with the asset’s balance responsible party or notify the balance responsible party of the start of reserve use. An agreement with the balance responsible party is required for aFRR and mFRR markets. Fingrid does not define the content of this agreement, but the reserve provider must notify Fingrid in writing of its existence. A notification template can be found on the product pages for aFRR and mFRR reserves.

- Sign an agreement with Fingrid.

- Reserve market agreements are specific to each reserve product. The reserve agreements signed by Fingrid are uniform in terms and content and are publicly available. Templates for the agreements and their appendices can be found on the product pages of the reserve products.

- If necessary, sign a settlement agreement with eSett.

- A settlement agreement with eSett is required for Reserve Providers participating in the FCR-N, aFRR, or mFRR markets.

- If the Reserve Provider also acts as a balance responsible party and already has an imbalance balance settlement agreement, a separate balancing service settlement agreement with eSett is not required. More information about these agreements is available on eSett’s website.

The Reserve Unit must:

- Meet the technical requirements specific to the reserve product.

- You can find the technical requirements on the product pages: FFR, FCR, aFRR, and mFRR.

- The reserve unit may consist of multiple reserve resources aggregated by the reserve provider. Individual resources do not need to meet the technical requirements alone if the aggregated unit meets them.

- The controllability of the reserve asset is verified through prequalification test (excluding mFRR). More about prequalification test below.

- Be located in Finland (excl. the Åland Islands) or be directly connected to the Finnish power grid.

- Fulfill the grid code specifications for grid connection.

- Read more about connecting to the main grid.

- Note that the grid code specification for a facility connecting to the grid are verified through commissioning tests, which are separate from the reserve prequalification tests.

Prequalification tests

As part of the path to participating in the reserve markets, the control capabilities and technical performance of automatic reserve assets - i.e., FFR, FCR, and aFRR - are tested through prequalification tests. In contrast, mFRR reserve assets are not subject to these tests.

A prequalification test is mandatory for all FFR, FCR, and aFRR reserve assets. These tests ensure that the asset’s control behavior complies with the technical requirements of the reserve product. The technical requirements define, among other things, the activation speed, the duration of continuous activation, and whether a recovery time is allowed. Detailed requirements are described in Appendix 2 of each automatic reserve product agreement, which can be found on the product page of each reserve. The steps for conducting the control test are also described in Appendix 2.

The aFRR prequalification test process differs from that of other products because aFRR reserve is activated according to an activation signal sent by Fingrid. Therefore, the Reserve Provider must establish real-time telemetry connections with Fingrid before performing the prequalification tests so that the activation signal can be sent to the asset during the test. The aFRR prequalification test is conducted together with Fingrid specialists.

How to get started?

Fingrid’s reserve market customer team guides new customers along the path to participating in the reserve markets, toward starting trading and active operation in the reserve markets. See the customer team’s contact information under Details.

Our email addresses follow the format: firstname.lastname@fingrid.fi.

Details

Tuomas Mattila

Thermal power, electric boilers, hydrogen

tel. +358 30 395 4180

Niko Korhonen

Wind power

tel. +358 30 395 4139

Tuire Kujansuu

Batteries

tel. +358 30 395 4157

Mikko Haapamäki

Solar power, aggregated units

tel. +358 30 395 4285